A hire purchase agreement is a type of leasing contract in which the lessee gets control of the asset during the agreed term. The interest rate that the bank offers you is 3 for 5 years.

He or she then makes regular repayments instalments.

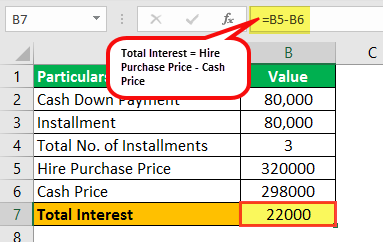

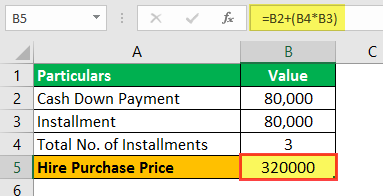

. This hire purchase calculator will show the principal and interest costs per month to show the level of extra payments on top of the items price that you will be paying as well as the size of the monthly principal payments. These transactions can also be executed with the help of a financier. Company purchase the furniture on hire purchase and the instalment for 3 years is Rs.

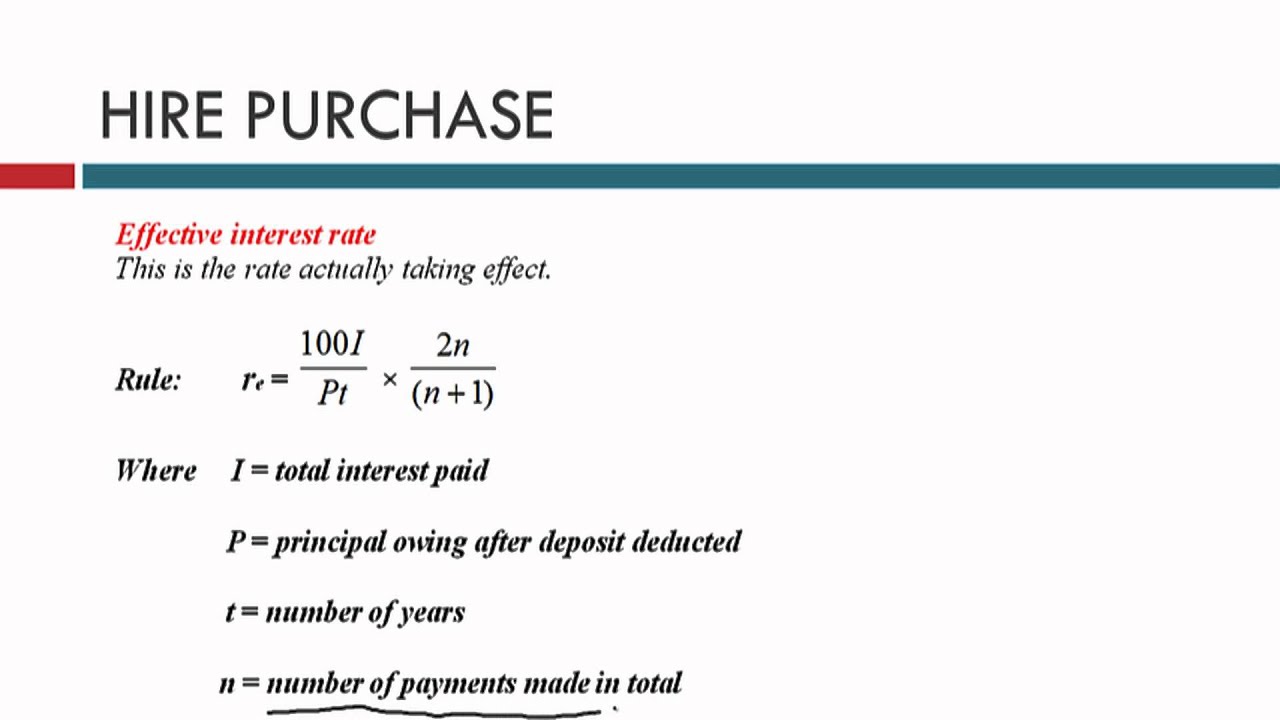

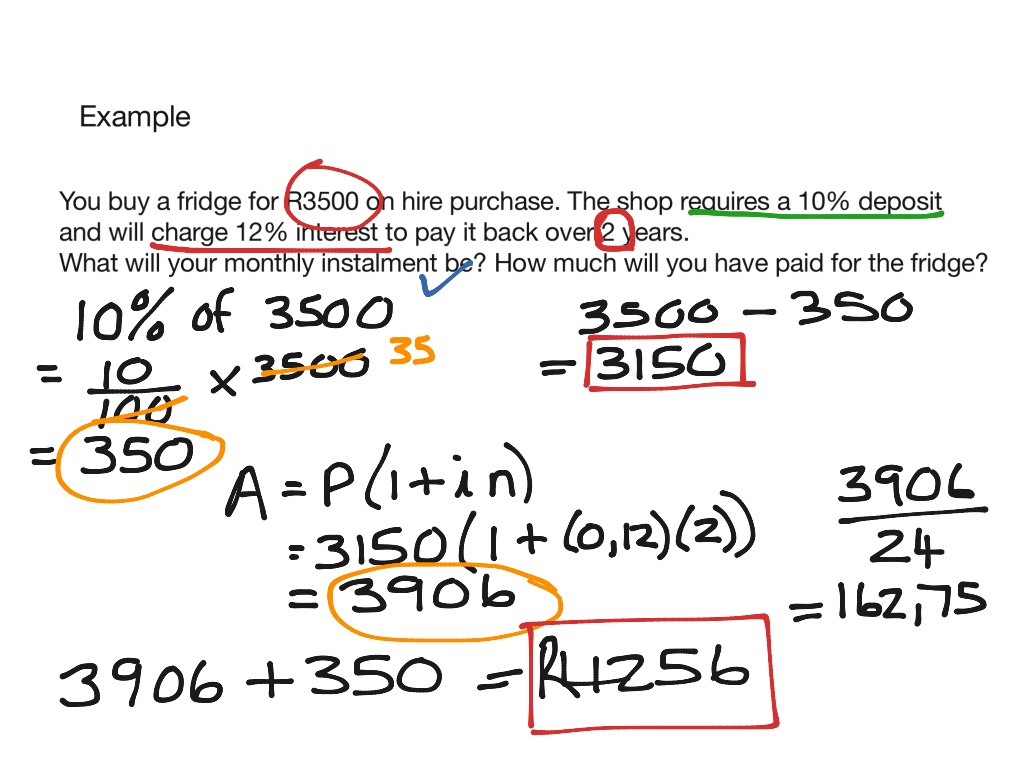

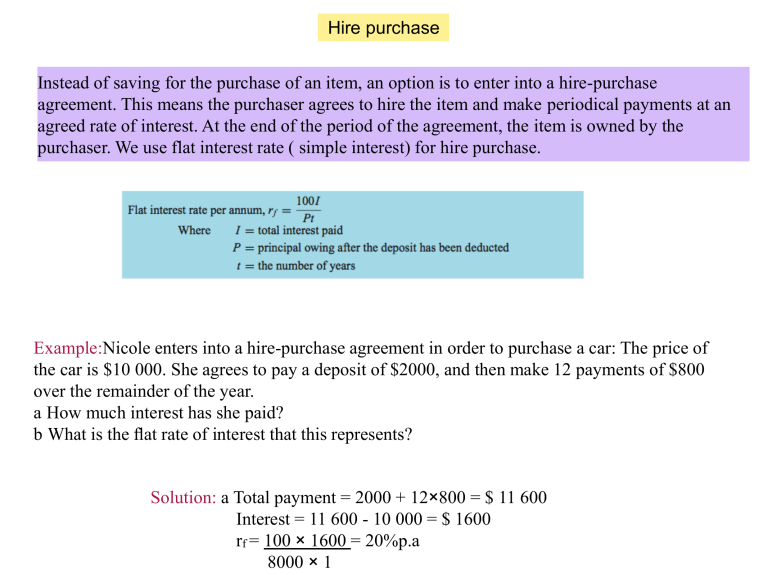

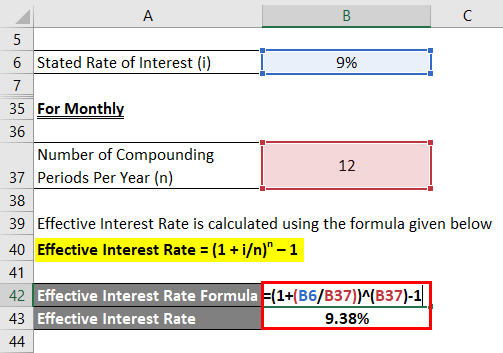

Calculate the interest on the amount you are borrowing. HIRE PURCHASE Under a HIRE PURCHASE contract a purchaser pays an initial deposit and takes the item away. The effective rate of interest in a hire purchase agreement is the interest rate that would be charged in an equivalent reducing balance loan.

Ownership of the goods is transferred when the last instalment is paid. When the interest amount is not separately disclosed or charged then the financier has to charge GST on full amount paid or payable on the hired goods. Most hire purchase deals are done over 36-60 month periods because this is how the lender achieves the highest interest.

Hello Everyone My name is Deepak Sinha and welcome to my YouTube channel. A buyer or hirer disburses a percentage of the total cash price as a down payment. Divide the interest by the total number of payments you will be making.

300000 100000 3 years. Real monthly interest rate paid to bank 04425 percent. Calculated Interest Charges RM.

Question 4 The purchase price of a car is 15 000. Hiring Period in Years Calculate. Total Interest charge base on 5 interest.

Transfer to Another Financier. If you do not know your interest rate enter your monthly payment and we. Hire purchase is calculated using the simple interest formula and interest is only calculated on the amount owing.

Find out the cash value. Hire Purchase Add to my workbooks 18 Download file pdf Embed in my website or blog Add to Google Classroom. RM100000 x 10 x 55 120 RM458.

Monthly Instalment Amount financed Total interest on amount financed Repayment period months RM50000 RM25000 60 RM75000 60 RM1250 Since term charges are calculated on the initial amount financed you will get a rebate on the term charges if you repay in full the balance due under the hire purchase HP. The monthly payment over 3 years is equal to 200. Use this online financial calculator and key in the values as such.

The monthly instalment is calculated as follows. Calculate monthly hire purchase repayment. Initial payment 10000 30 3000.

We see how a loan amount grows according to the simple i. For accounting point of view both hire purchase and instalment payment system are same. Interest Rate pa.

3 000 2 000 and 1 000. A Cash price is that price which will be paid if any asset is purchased on cash without installment. Balance payable to bank 90000 x 1 7 x 00285 107955.

The interest charged 5 pa. 000 Monthly Repayment RM. Theoretically your monthly instalment from your loan amount of RM100000 should be RM834 per month RM100000.

Calculate total balance payable to bank. The interest charged 5 pa. You pay a 10 downpayment which is RM10000 and apply for an RM90000 loan.

Before accounting we should know following things. S Starting amount after deposit has been subtracted no interest i Interest rate divide the by 100 and then again by 12 4 or 6. Hire purchase is a legally binding agreement.

Hire purchase and simple interest short answers ID. Assuming you purchase a new Office Equipment at 20000 and financed it with a Hire Purchase plan. This would be your flat rate interest per instalment calculation.

If the hire purchaser becomes defaulter the hire vendor has the right to take away the goods and forfeit the instalments received as hire charges for the use of goods. Hire purchase Other contents. Get estimate from our hire purchase calculator to help you to calculate possible monthly repayments.

The buyer settles the outstanding sum and interest in periodic installments. B Hire price cash price interest for risk of giving asset on instalment. A and company ABC have made the hire purchase agreement of the car.

That means you are paying interest of RM13500 over the course of 5 years. The instalments include both repayment of the debt and the interest being charged by the vendor. Calculating the hire purchase loan.

The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense. A Total amount after interest. See answers 3 Best Answer.

Hire Purchase System - Features Under the hire purchase system goods are sold on instalment basis. Find out the cash value. Hire purchase is explained and examples on hire purchase are done using the simple interest formula.

As a general rule the price of a Hire Purchase is calculated as follows. Now do note that this is just the interest per instalment no matter how much you have paid down on your principal loan amount. We will calculate your payments total costs total interest charged and provide a schedule of payments detailing each month of the contract to show you the remaining balance at each payment.

When the financier transfersassigns the instalment credit facility in a hire purchase agreement to another financier such a transfer or assignment is an exempt. Use our HP Hire Purchase calculator to get a full breakdown of your HP deal. Monthly loan repayment 10795584 128518.

000 Total Payment RM. At the end of the period of the agreement the purchaser owns the item. 63900 x 35 month.

A S 1 in Where. In essence the lessee hires these assets and uses them during a specific period. Assuming you are buying a car that cost RM100000.

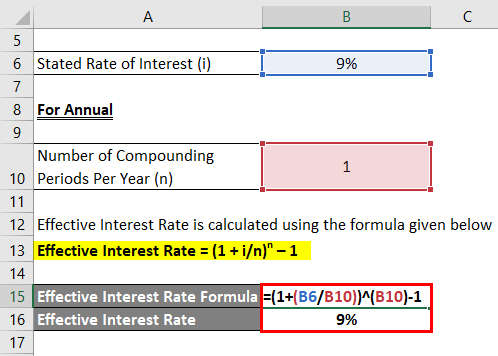

During this period they provide the lessor with several payments which include interest and principal amounts. With a lease agreement such as Contract Hire there tend to be considerably more discounts available to customers than there are for a finance. Calculate the effective rate of interest under the terms of this agreement.

Topic - How To Calculate Interest When Cash Price Is Not Given.

Hire Purchase System Part I Wikieducator

Lease Accounting Operating Vs Financing Leases Examples

Hire Purchase Meaning Agreement Calculation What Is It

Hire Purchase Meaning Agreement Calculation What Is It

Hire Purchase Meaning Agreement Calculation What Is It

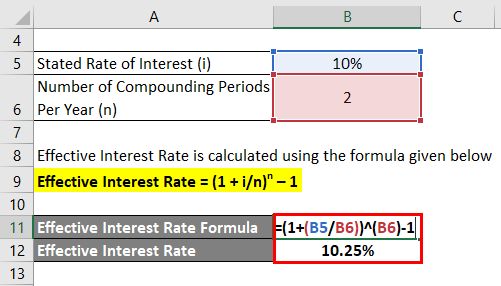

Effective Interest Rate Formula Calculator With Excel Template

Finance Hire Purchase Math Showme

Effective Interest Rate Formula Calculator With Excel Template

2 Hire Purchase Accounting Calculation Of Interest When Rate Of Interest Is Not Given Kauserwise Youtube

Hire Purchase Meaning Agreement Calculation What Is It

How To Calculate Flat Rate Interest And Reducing Balance Rate

Accounting For Hire Purchase Accounting Education

Realtimme Cloud Solutions Helpfile

Hire Purchase System Part I Wikieducator

Rate Simple Interest For Hire Purchase

How Is The Price Of A Hire Purchase Calculated Osv

Effective Interest Rate Formula Calculator With Excel Template

Effective Interest Rate Formula Calculator With Excel Template